Twenty-one months after the nation’s first confirmed case of the coronavirus, the U.S. economic system stays rocked by conflicting forces, with companies and households struggling to regulate to what many hoped can be a short lived disruption. Uncertainty obscures the trail ahead. Backlogged provide chains have left ships – and the imports they carry –

Twenty-one months after the nation’s first confirmed case of the coronavirus, the U.S. economic system stays rocked by conflicting forces, with companies and households struggling to regulate to what many hoped can be a short lived disruption.

Uncertainty obscures the trail ahead. Backlogged provide chains have left ships – and the imports they carry – caught exterior key U.S. ports. Inflation has pushed up the price of on a regular basis objects and costs aren’t easing. Restaurant reservations have seesawed for months, arising and down as Individuals take into account whether or not they really feel secure amid the continued pandemic.

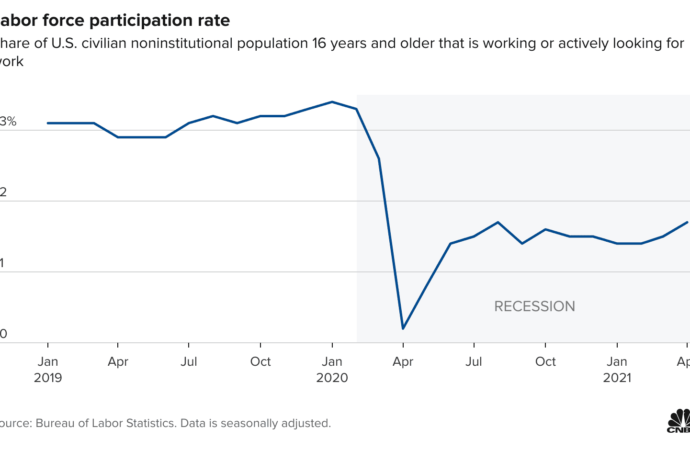

In the meantime, the labor market has whipsawed tens of millions of Individuals by means of layoffs after which rehirings, with tens of millions caught in between. Wages are up, and persons are switching jobs are a document fee. And whereas progress for the yr continues to be projected to method 6%, White Home and Federal Reserve officers underestimated the financial disruption that might persist by means of the pandemic’s second yr. Now it seems sure that many of those strains, each financial and viral, will proceed nicely into 2022, and maybe past.

“There’s simply no street map to opening a world economic system in a pandemic, and folks preserve forgetting we’re nonetheless in a pandemic,” mentioned Diane Swonk, chief economist at Grant Thornton. Now the restoration doesn’t solely have to repair what was misplaced, however the “scars and wounds need to heal” after hard-hit employees and industries reevaluated their futures, Swonk mentioned.

Swonk pointed to actor William Shatner, who blasted into house a number of days in the past and drew a comparability to what’s unfolding within the economic system: “We’re seeing some friction upon reentry.”

• Wage progress spikes for some. As many corporations tried to reopen quickly, they complained that it was troublesome to seek out employees who had been prepared to simply accept the identical pay and situations that had been supplied pre-pandemic. So plenty of corporations hiked wages to attempt to lure employees away from different jobs. This pushed up revenue, particularly for employees who’re prepared to leap ship for a brand new employer.

Staff who change jobs nearly all the time earn bigger raises than those that stick on the similar employer, however that hole has opened to widest level in additional than 20 years. Job switchers acquired a typical hourly elevate of about 5.4% from a yr earlier, in accordance with the Federal Reserve Financial institution of Atlanta’s wage tracker, which analyzes Bureau of Labor Statistics knowledge.

Rising wages is usually a good factor, giving employees more cash to spend to assist the economic system develop. However economists fear concerning the ripple results of rising wages on the similar time that corporations are struggling to fill greater than 10 million empty jobs. If employers hike wages to draw employees, they could in flip need to go these increased labor prices on to customers within the type of increased costs. That might ship inflation even increased.

• Will worth progress persist? For months, officers on the Fed and White Home have argued that inflation is a “transitory,” or momentary, characteristic of the financial restoration, like an outdated automotive lurching into gear. The expectation from many high Washington financial officers is that after provide chains have time to clear their backlogs, inflation will calm down nearer to the Fed’s 2% annual goal, someday subsequent yr.

However that message is turning into more and more exhausting to defend. “Momentary” has lasted for months, and it’ll final for months extra. The September shopper worth index exhibits annual worth progress got here in at or above 5% for the fifth consecutive month. Plus, final month’s rising meals and shelter prices collectively contributed to greater than half of the month-to-month improve of all objects, when seasonally adjusted, making it more durable for folks to afford on a regular basis bills. Wages are rising, however that improve is getting eaten up by increased prices.

All through the pandemic, new and used vehicles have been a litmus take a look at for the nation’s provide chain points and associated worth hikes. The market depends closely on trade-ins and auto components, that are in low provide amid a world microchip scarcity. Used vehicles and vehicles have pushed a surge in inflation this yr and are up a whopping 52% since September 2019.

However the Fed and the White Home don’t solely have to manage inflation. In addition they have to manage the way in which they discuss it. Customers could also be watching the indicators Washington’s leaders ship about whether or not increased costs are sticking round. One Fed official is ditching the phrase “transitory” altogether, saying it provides the general public a false expectation that top costs will cool in a short while body.

“It’s not simply the time, it’s whether or not that is turning into a little bit extra embedded within the underlying inflation tendencies. That’s what we had been considering by way of ‘transitory,’” mentioned Tim Duy, an economist and Fed skilled on the College of Oregon. “And more and more, I’d say it seems like it seems that the worth pressures are extra widespread, and consequently, extra more likely to end in elevated underlying inflation going ahead.”

Eating places’ backside traces have recovered with stunning pace in latest months. Knowledge launched by the Census Bureau on Friday present restaurant gross sales topped $72 billion in August – about in step with the extent that might have been anticipated had the pandemic by no means occurred. However employment within the sector in September remained about 1,000,000 jobs under its prerecession ranges, at the same time as employers posted a near-record variety of job openings – 1.5 million in August alone. And the restoration has been uneven. Some eating places are doing a lot better than others.

The disconnect is probably going associated to the pandemic, as excessive ranges of covid-19 circumstances look like associated to falling restaurant employment. In Detroit, Nya Marshall remembers when the delta variant got here “knocking at everybody’s door” over the summer season.

Going into the autumn, Marshall is working her restaurant, Ivy Kitchen, with lowered hours and shifts. She mentioned employees didn’t rush again on the payrolls when unemployment advantages expired and that many are leaving the business altogether, particularly whereas youngster care is a urgent concern. Enterprise continues to be down 52 % in comparison with pre-covid ranges. And Marshall is aware of she’s not alone.

“Delta is right here, and there’s a false impression that the eating places have recovered, that we’re again to the place we had been,” Marshall mentioned. “Persons are not comfy popping out. And in the event that they do, we’re lucky the patio continues to be open. However patio season is ending quickly.”

• Provide chains are slammed. Why all that inflation? Costs for used vehicles and different import-reliant objects have risen quickly as covid-19 wreaked havoc on international provide chains that had been already stretched skinny by Individuals’ extended pandemic-era goods-buying binge. Lots of the items which are efficiently offloaded from ships find yourself stranded in U.S. ports as trucking corporations battle to rent and rail yards undergo their very own backlogs.

Earlier than the pandemic, container ships would often sail instantly from China to a berth on the ports of Los Angeles and Lengthy Seashore. However for the reason that first pandemic winter, an increasing number of container ships have wanted to attend in San Pedro Bay for an opportunity to dock and unload their cargo, peaking at 40 ships in February. Coronavirus circumstances dropped within the spring, and the backlog of ships began to go down. Because the delta variant emerged in america, although, the variety of ready ships spiked alongside coronavirus circumstances. Greater than 70 ships waited offshore on Sept. 19.

In the meantime, cargo languishes on container ships. Delays in getting cargo off container ships are handed on by means of the provision chain. Federal Reserve Chair Jerome Powell informed lawmakers final month that the supply-side constraints on the economic system have, “in some circumstances, gotten worse,” including that “we’d like these provide blockages to alleviate, to abate earlier than inflation can come down.”

The Biden administration a number of days in the past introduced a 24/7 operation at a key U.S. port and is working with main importers to clear a path for cargo forward of the vacation season. Firms like Walmart, FedEx and UPS have additionally dedicated to utilizing the prolonged hours on the Port of Los Angeles to dump delivery containers contributing to the freight backlog.

Pulling off a round the clock effort will depend upon cooperation with foreign-owned delivery corporations and operators throughout the transportation sphere, mentioned Frank Ponce De Leon, the Worldwide Longshore and Warehouse Union’s Coast Committeeman for the Coast Longshore Division.

“This drawback shouldn’t be going to vanish in someday, in a single month. It’s going to be a continued drawback for some time now,” Ponce De Leon mentioned. “There are issues that may change . . . not solely on the docks, however for the trucking business, for the warehousing business, the railroad business. We will transfer cargo without these three components of the puzzles.”

– – –

The Washington Put up’s Laura Reiley and David J. Lynch contributed to this report.

Leave a Comment

Your email address will not be published. Required fields are marked with *